It’s not the most exciting or interesting part of your working holiday in Canada but taxes still need to be done!

Filing your taxes after a working holiday in Canada can also be quite beneficial, in the form of a tax refund if you have overpaid tax.

If you’re like me and used to the government in your home country automatically calculating tax (and refunds), the idea of filing your own taxes can be a bit intimidating.

Since moving to Canada we’ve had to file our taxes a couple of times now and I can assure you that it’s not as complicated as it sounds, especially as there are a few options that can make the process easier.

Updated February 2024

There are some affiliate links included in this post. If you make a qualifying purchase through one of these links, I may receive a small percentage at no extra cost to you.

Canadian tax return basics

The Canadian tax year runs from January to December.

Though you may have noticed tax being deducted from your payslip already, you need to file your own taxes after the end of the tax year to make sure that the correct amount of tax has been paid.

Tax season usually starts in February for the preceding year i.e. tax returns for 2023 can be filed starting February 2024.

The deadline for filing taxes is usually at the end of April. In 2024, the deadline is 30th April.

If you haven’t filed by the deadline but do not owe any taxes, then it is no issue.

If you do however owe any taxes in addition to what you have already paid, then there will be a penalty to pay.

Whether you are eligible for a refund or not depends on a variety of factors. Keep in mind though that you will never get 100% of the tax you have paid back.

A certain amount of tax, as well as E.I (Employment Insurance) and CPP (Canadian Pension Plan) must still be deducted from your income, even if you’re in Canada on a working holiday.

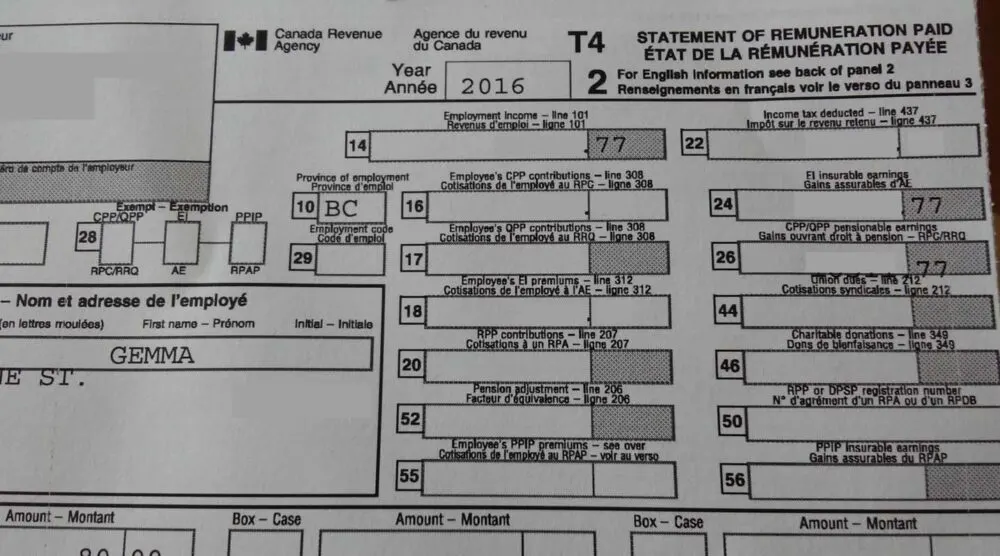

Canadian tax return: T4 details

A T4 is an information slip prepared by employers to summarise how much money you earned and how much income tax was deducted.

To be able to file taxes in Canada, you will need a T4 from every employer you have worked for during that tax year.

At the end of the tax year, any employer you have worked for during that year will provide you with a T4 by the end of February. They are legally obligated to do so.

Some of my employers have provided this by email, while others still prefer good old snail mail. If you leave Canada mid-way through a tax year, you will still have to wait until the end of the year to receive your T4.

You cannot file your taxes without your T4(s). It is possible to apply for a refund not only on your income tax but also on certain other expenses such as medical or work-related costs.

Working out your residency status

When filing your taxes in Canada, you will need to know your tax residency status. Whether you are considered a resident or non-resident of Canada for tax purposes entirely depends on your individual situation.

There are no hard and fast rules whether a working holiday participant is a resident or non-resident, it is based on your individual situation.

There are so many unique scenarios that make it difficult to definitively state whether you are a resident or non-resident.

I have written a separate article all about determining your tax residency status that may help (link below) but otherwise, I’d highly recommend consulting either the CRA, an accountant or a professional tax filing company.

How to file your taxes on a working holiday in Canada

Once you have your T4(s) ready, you will also need to grab your Social Insurance Number (SIN) and then work out the method you want to use to file your tax return in Canada.

The general difference is the cost and amount of effort involved. Everyone approaches their taxes differently:

- If you like control and/or are on a budget, consider completing the process yourself

- If paying someone else $50-100 to deal with your tax return sounds good, think about using a tax filing service

1. Complete the process yourself by mail (cheapest, most effort)

This method is free, except for postage. You can download, print, complete and send the tax forms directly to the CRA (Canada Revenue Agency).

Packages of forms are also available from Service Canada offices and Canada Post.

If you decide to use this method, you will need to read up and decide whether to apply as a resident or non-resident.

2. Use tax software to help complete the forms (cheap, less effort required)

You can also buy or download easy-to-use tax return software to enter your information into. The program will complete the calculations for you and generally make the process more simple.

- If filing as a resident or non-resident of Canada and it is your first ever tax return in Canada, then you have to do is print off the forms and send them to the CRA in the mail

- If you are filing as a resident of Canada and it is not your first return, you should be able to send your return directly to the CRA online via the Netfile service

Note that the free or low-cost tax filing software is often limited to just one return (so you can’t share the program around) and one T4.

So if you have more than one T4, be sure check the limitations of the program before purchasing or downloading.

3. Hire an accountant or company to prepare your forms (mid-range cost, easier)

This option involves paying an accountant or company to fill out the forms with information provided by you, with the starting price around $40-50.

Be aware that not every tax preparation company will have lots of experience processing tax returns from people on working holidays.

Some companies may even tell you that they do not do returns for non-Citizens/Permanent Residents.

4. Use a tax filing service for the whole process (most expensive, easiest)

Tax filing companies will effectively do everything for you from start to finish. It is estimated that over half of Canadians choose a company to file their taxes for them. This tax filing method is usually the most expensive ($60+).

The most straightforward and hassle-free option is to use an international tax filing service such as taxback.com (5% discount with this link), which specialises in filing taxes for working holiday participants.

Taxback will give you a free estimate and then charge you a set fee if you wish to continue. They work to make sure you receive the maximum refund available (the average tax return from Canada is $900).

Jean Robert used Taxback to apply for an Australian tax return after he’d returned to his home in Canada.

As well as making the process super easy, he received a substantial amount back which he was extremely happy with.

Filing taxes outside of Canada, after your working holiday?

If you’re filing outside of Canada, then you have only two real options for filing your taxes.

The first (slower) is to download the forms from the CRA website, complete and then mail them to the CRA in Canada.

If you’re due a refund, CRA will send you a cheque in Canadian dollars to your international address.

Be aware that your bank may charge a fee to process a foreign cheque or may not accept foreign cheques at all.

The other (faster) is to use an international tax filing service such as Taxback.com, as mentioned above. They send tax refunds via bank transfer.

Found this post helpful? Subscribe to our IEC newsletter!

Working holiday advice and updates delivered straight to your inbox, with a FREE printable IEC packing list

Check out these other posts about working holidays in Canada

One half of the Canadian/British couple behind Off Track Travel, Gemma is happiest when hiking on the trail or planning the next big travel adventure. JR and Gemma are currently based in the beautiful Okanagan Valley, British Columbia, Canada

Scott

Friday 9th of October 2020

Hi,

I am about 1 year into my 2 year IEC working holiday. I worked at a kitchen and a retail store during my first 6 months here but I have since gone fulltime freelance working remotely. I have been setting aside 30% of each payment I receive for tax purposes and am planning to have an accountant do my taxes come tax time. Is this all I need to do to be compliant with IEC visa & Canadian tax regulations? Are there any rules or requirements for freelancers as far as IEC visa's go?

Thanks in advance!

Gemma

Friday 9th of October 2020

Hi Scott,

Depending on where you live, you may need to register your business with the local city or municipality. You'll also need to register for GST once you have earned over $30,000 in the tax year.

Avril Noonan

Tuesday 21st of February 2017

Hi Gemma,

Can you send me some information. I am no longer living in Canada but need to file my 2016 taxes. I moved bank to Ireland in April, I still have a Canadian bank account and address that I can use. Do I file as a resident or must I file as a non resident, would this make a diferance to my returns owing?

Gemma

Wednesday 1st of March 2017

Hi Avril,

Yes, filing as a non-resident or resident would generally make a difference to whether you owe money (and how much) or have a return owning. Whether you file as a non-resident or resident entirely depends on your situation and interpretation of the definitions - consider contacting CRA for advice.

Sarah Bloomer

Tuesday 7th of February 2017

Hey,

I am here on a Working holiday visa and I wanted to know if you had to pay CPP? I've only been here for four months. I am self employed here and working as a contractor. Is it enough if i save around 25% of my earnings?

Thanks,

Sarah

Jessica

Wednesday 9th of November 2016

Hi Gemma,

Your website has been very helpful! I was also wondering if you could possibly email me some info. I am also in a similar situation to Michael and Lauren where I am under a Youth Mobility Visa in the UK, but have a couple secondary residential ties to Canada. However, I have not been in Canada for 183 days. Thanks!

Marta

Thursday 3rd of November 2016

Hello Gemma, I'd love to get the email everyone is requesting :) I have just started contemplating how I will do the tax return when the time comes so your post has been very helpful. One thing I haven't successfully resolved is how I will receive the potential tax refund. I guess I will have to leave my bank account open beyond my stay in Canada and then close it when the WHV is done. If you have any suggestions about what else is possible in terms of refunds, I'd love to get your input. Thanks again for your help!