Along with filing taxes, buying travel insurance is likely to be the least exciting part of your working holiday. It is, however, a pretty important part.

Injury and illness can happen wherever you are in the world, but medical care usually isn’t free.

This post will help you choose the best working holiday travel insurance for you, with advice and tips gained from our own experiences living and working in four different countries.

There are affiliate links in the text ahead. If you make a qualifying purchase through one of these links, I may receive a small percentage of the sale at no extra cost to you.

Insurance for work AND play

It sounds obvious but before you buy travel insurance, make sure it covers what you will do on your trip. Most standard travel insurance policies only cover pleasure activities, so make sure having a job and working is OK.

If you’re thinking of doing a ski season, coverage for skiing, snowboarding and all manner of other snow-related activities is, (somewhat unsurprisingly) absolutely essential.

Coverage to visit home

A lot can happen in a year or two; sometime during your working holiday, you may find yourself wanting or needing to return to your home country for a short visit or event like a wedding or funeral.

Returning to your home country automatically cancels most travel insurance policies unless specifically stated otherwise, but a minority allow one or two short trips (typically up to 14 days).

Long policies and extensions

With working holidays available in Canada, New Zealand and Australia for up to two years in length, you will, therefore, need travel insurance lasting up to two years in length too.

The problem is that there are not many insurance companies that offer policies of this length. There are however at least a couple of different options for the most common nationalities for working holidays. Head to the bottom of the article to read about these options.

One-way flight

Flights can usually only be booked 12 months in advance, so if you’ve planned a long trip or prefer being spontaneous, it is very likely you will be flying out on a one-way flight.

Some insurers do not cover people on one-way flights, so be sure to check that this isn’t an issue when purchasing your working holiday travel insurance.

A fair amount of insurers, however, do not cover people on one-way flights.

The importance of adequate coverage

So maybe you’re reading this thinking you’ll just buy any old policy to satisfy a border guard and it won’t matter too much.

The thing is, it does matter because if you actually have to claim on an insurance policy, you want your coverage to be valid.

Without a valid policy, your chances of getting any money from your travel insurance are close to nil.

To process a claim, an insurer will ask for all sorts of evidence to support your request such as flight tickets alongside medical receipts.

If you have done something to invalidate your insurance (arrived on a one-way flight, visited home one too many times), it is likely to be discovered. And then you’ll be out of luck and money.

Working holiday requirements

Valid insurance for the entirety of your planned stay is often a condition of your working holiday visa/work permit.

Border guards do not necessarily ask everyone for proof of it, but you will be sent home if you do not have it. Simple as that.

If you only have six months insurance, you may only be given a visa/work permit for six months.

Secondly, insurance is also important if the worst happens. Or not even the worst case scenario happens, as things go.

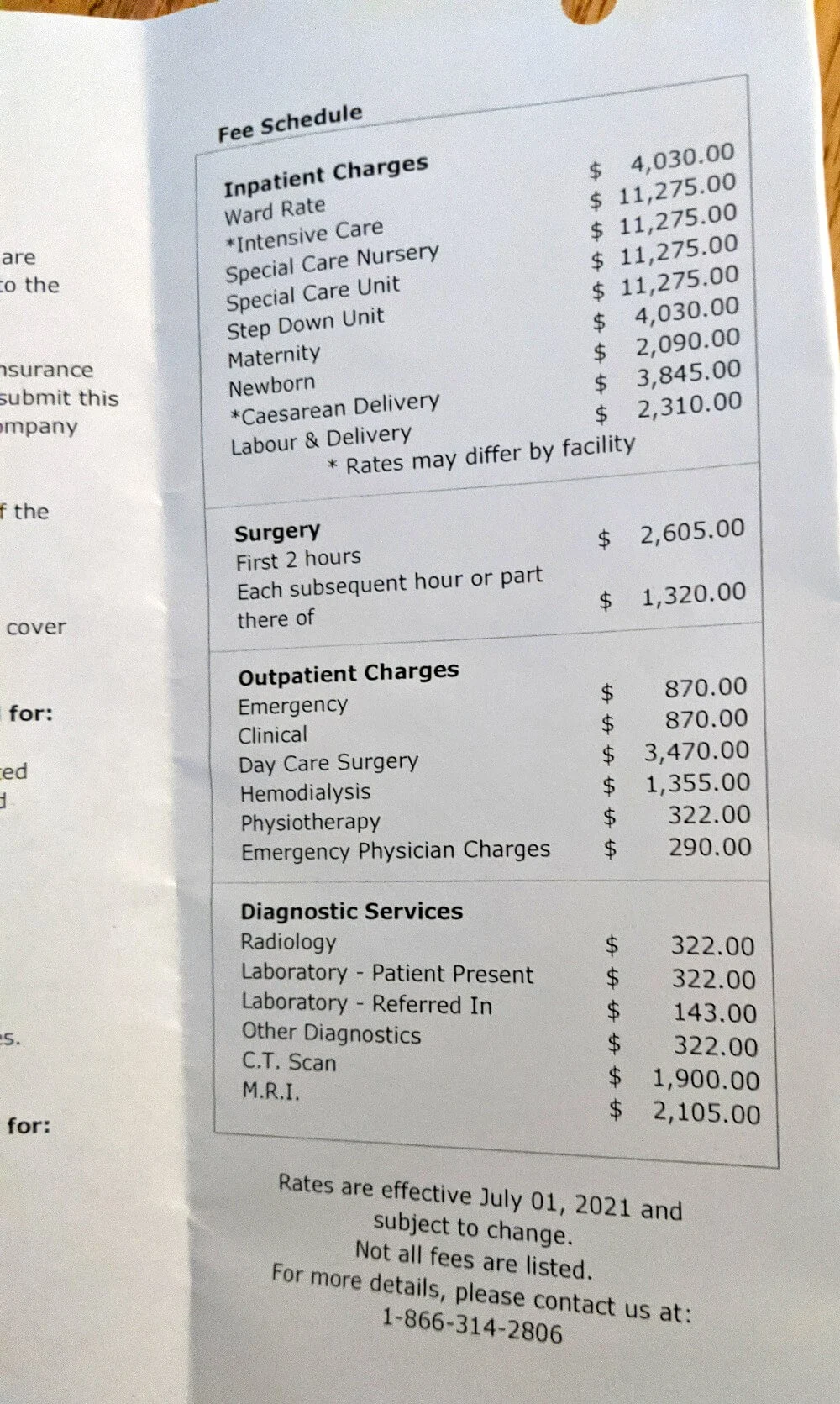

With a working holiday visa in hand, you are still a foreigner in your new country and are not necessarily entitled to the same free or low-cost healthcare other residents are.

Even if you do manage to register for local healthcare through employment or otherwise, it may only cover basic rather than emergency care (did you know you have to pay for ambulances in Canada and Australia?!)

Local healthcare will also not allow you (or your remains) to be flown home to your home country due to serious injury or death. Without insurance, your family would have to pay for this. No-one thinks it will ever happen to them until it does.

How to search for the best travel insurance for your working holiday

The first place to start is with the actual travel insurance policy. Yep, the small print!

If there is some legalese you do not understand (or you have a specific question regarding the coverage), reach out to the insurer to be sure.

As a British citizen, I used True Traveller as my working holiday travel insurance provider (before I became a Permanent Resident of Canada) as they ticked all the boxes for me:

- 24 month policies available

- Medical (and personal liability) coverage in the millions of £s

- One-way flights OK

- Lots of special activities covered including winter sports

- Multiple visits home allowed (with no maximum length!)

- A variety of jobs covered

- An excellent online reputation of paying out for claims (check the reviews)

- Policies can be started when ‘already travelling’

- Extensions possible if on short policy

True Traveller also offer policies for EU citizens, including those from Ireland, Germany and the Netherlands.

Not from a country covered by True Traveller? No problem.

More working holiday insurance providers

Australian citizens – Consider Cover More or Fast Cover. With Cover More, 2 x 1 year policies would provide coverage for 24 months. For Fast Cover, an initial 12-month policy can be purchased and then extended for another 12 months on the departure date.

New Zealand citizens – Check out Cover More. 1 x 12 month policy and another 11 month policy would provide coverage for 23 months. Winter sports coverage is available for an additional premium.

Not from any of the countries listed? Best Quote are travel insurance specialists partnered with some of the largest and most reputable insurance providers in Canada.

Through them, it is possible to review, compare and purchase IEC specific insurance policies with up to 2 years of coverage.

The 2 year IEC policies cover basic (non-competitive) ski cover as standard. Some options also include coverage for Covid19 related claims. There are various coverage amounts available (most starting at $100,000), and adjustable excess levels as well.

Adventure in your inbox

Subscribe to our monthly email newsletter and receive a round-up of our latest outdoor adventures plus other exciting beyond the beaten path destinations

We never share your information with third parties and will protect it in accordance with our Privacy Policy

Check out these other posts about working holidays

One half of the Canadian/British couple behind Off Track Travel, Gemma is happiest when hiking on the trail or planning the next big travel adventure. JR and Gemma are currently based in the beautiful Okanagan Valley, British Columbia, Canada

Lily

Saturday 4th of January 2020

Canadian here! Looking to buy a travel health insurance for a working holiday visa to Sweden for up to a year. I'm finding it hard to find options =( It also needs to have a cancellation policy in case my visa is rejected, and hopefully has the option for short visits home.

Any leads appreciated. Thanks!

Gemma

Saturday 4th of January 2020

As a Canadian, I personally use World Nomads. Visits home are allowed. Most insurance providers offer a short window for cancellation after the initial purchase. So I'd suggest that you don't purchase the insurance until the last minute, if possible.

Harriet

Wednesday 3rd of June 2015

Hi Gemma,

Thanks for such useful information. I was wondering whether all insurance companies that offer insurance compatible with IEC is around the same price as True Traveller.

Thanks!

Gemma

Thursday 4th of June 2015

Hi Harriet,

There are only a few companies out there that offer 2 year travel insurance for British IEC participants. There are a couple that are cheaper than TT.